On-demand — and affordable — insights

Banks today have an enormous volume of data related to their customers, products and performance but often lack banking analytics solutions for aggregating and analyzing that data because systems tend to be highly manual and siloed. The result is missed opportunities to apply data effectively and strategically to meet your business goals.

If your bank has long assumed that data analytics is too expensive and beyond your reach, it’s time for a second look.

Banking analytics solutions

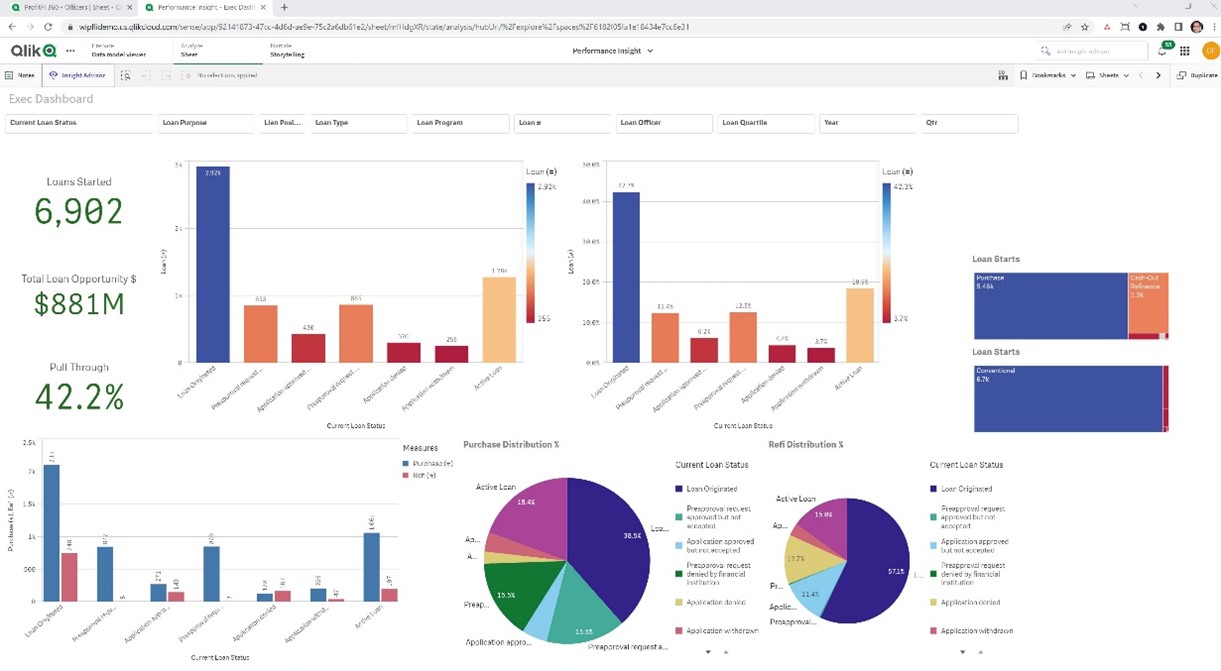

The Jack Henry core data you already rely on can be turbocharged with a ready-to-go analytics foundation created as a self-service tool for bank professionals. This affordable analytics jump-start solution empowers your bank to discover and analyze a wide range of vital information including:

- Account balance trends.

- Customer data and customer account data analysis.

- Loan officer productivity reporting.

- Branch activity reporting.

- Suspicious activity.

As a self-service tool, it also eliminates the need for spreadsheets or requests to your already overloaded data specialist. Any bank professional with authorization can access the dashboards and create the reports they need to address business questions, show account trends and inform a strategic decision.