Challenges like cybersecurity, talent shortages and digital engagement maturity continue to

shape strategies and priorities.

“Credit unions are at a pivotal moment where strategic adoption of AI and digital transformation

can define their future success. To compete on a national scale, they must integrate their tools

and data intentionally, ensuring seamless member experiences and robust security,” said Anna

Kooi, Wipfli’s financial services practice leader.

“By aligning innovation with core objectives, credit unions can deepen relationships, enhance

efficiency and build resilience in an increasingly competitive landscape,” Kooi said.

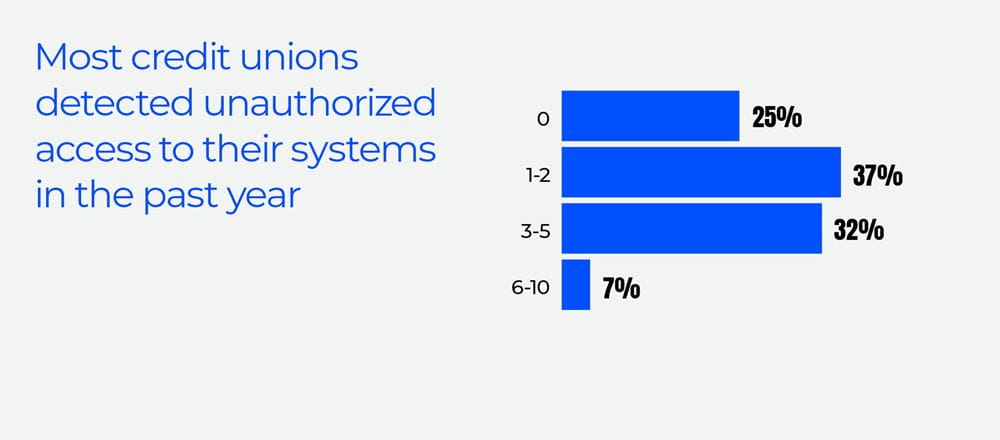

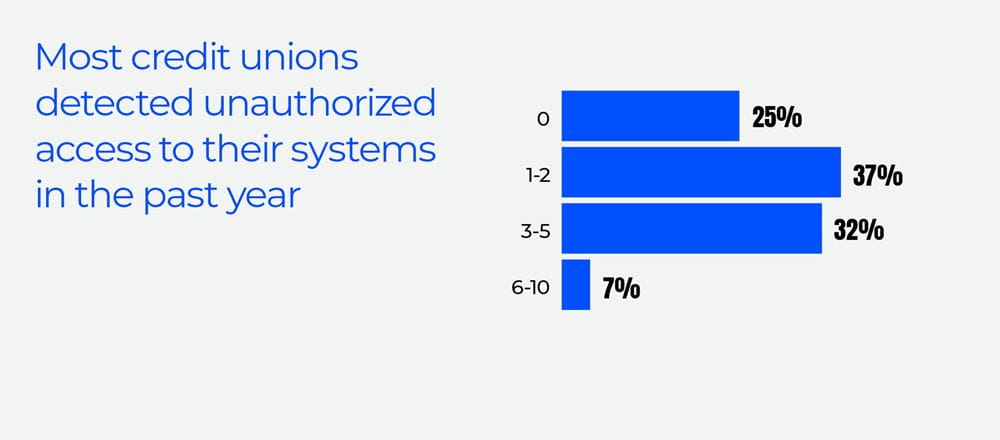

Cybersecurity (including fraud) was the leading concern for credit unions in this year’s survey — and for valid reasons: 76% of respondents said they detected unauthorized access to their networks, which was up from last year.

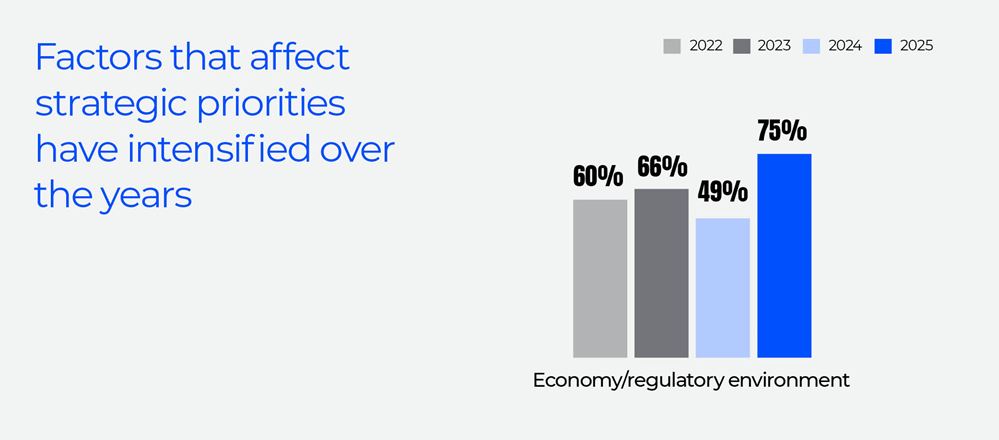

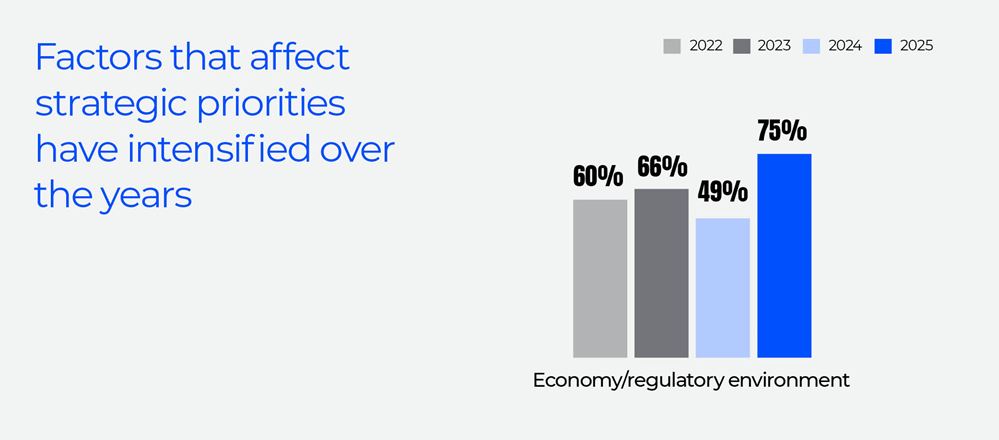

The economy and regulatory environment’s impact on strategic priorities increased significantly over the past year, respondents reported.

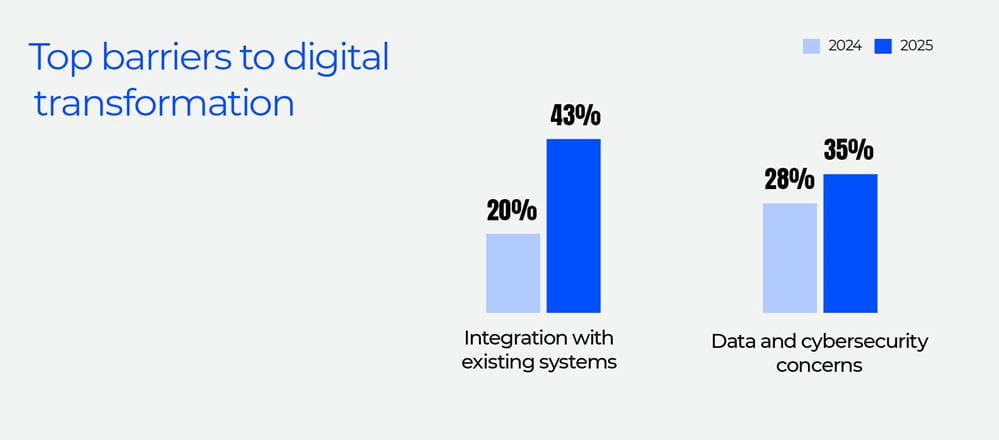

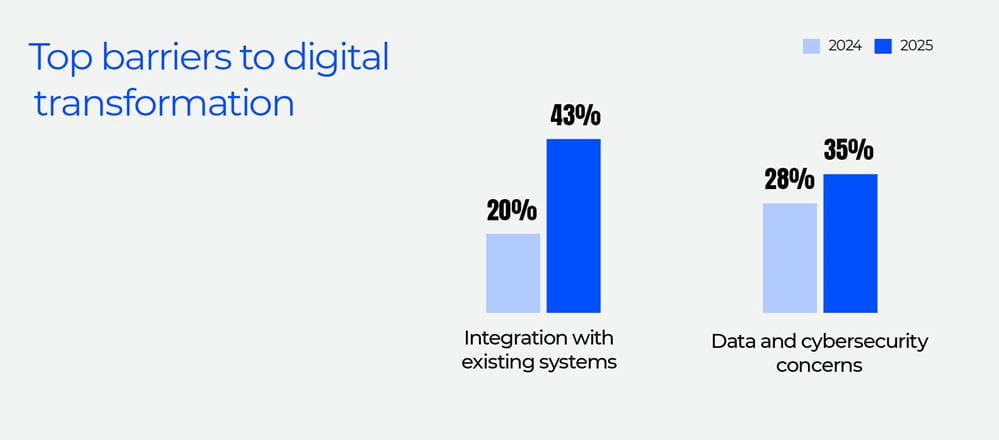

Only half of credit unions surveyed said they have reached a mature state of digital transformation. What’s holding them back? Integration with existing systems and data/cybersecurity concerns

“The massive wave of wealth transfer coming to Gen Zers — who engage with financial institutions differently that prior generations — means credit unions can’t keep kicking the digital transformation can down the road,” Kooi said.

Also in the report:

- Net interest margin compression worries are affecting strategic priorities.

- A breakdown of what cybersecurity investments credit unions are making.

- How many are using AI-based tools.

Access the full report for a deeper analysis and a detailed breakdown of all the data. For media

inquiries, contact Alicia O’Connell at alicia.oconnell@wipfli.com.

Download the full report