Private Equity Fund Formation: 101

Mid-stage and mature companies can start private equity (PE) funds to help them restructure or grow. If structured correctly, PE funds can be a lower-risk way to raise money compared to venture capital or other means.

Here’s what you need to know.

The ABCs of PE

Private equity funds can be formed by individuals who want to raise capital to put toward an investment. For example, maybe an individual wants to acquire an ownership stake in another company.

The funds are owned by accredited investors who pledge to invest a set amount of capital over time. Individuals who form the fund are responsible for sourcing, acquiring, and managing its investments until there’s an optimal sale opportunity. The goal is achieve an above-market return on the investment.

Common PE structures

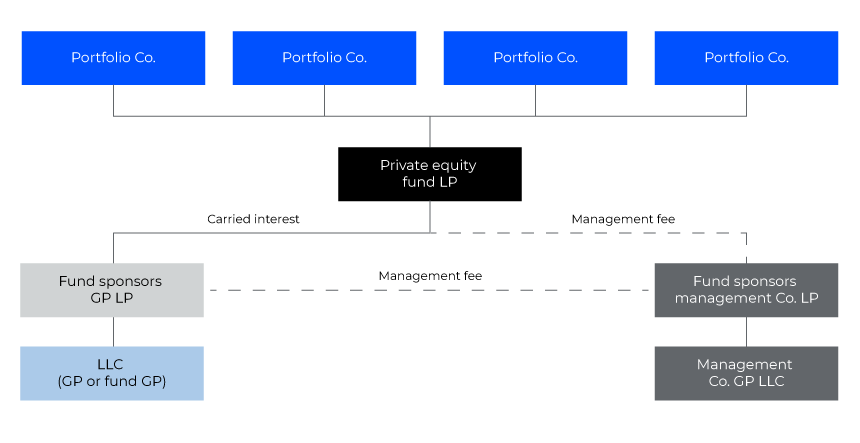

The prevailing industry standard is to form a management company, an investment fund (private fund), and a general partner (GP) when offering a PE opportunity to accredited investors (see fund structure below).

Legal requirements for PE formation

Certain legal documents are typically used in private equity fund formation. The industry standard is to compile a subscription package, which includes a private placement memorandum, a copy of the organizational agreement (i.e., limited partnership or limited liability corporation), a subscription agreement, and an investor questionnaire, at the minimum.

- A private placement memorandum includes general terms and risk factors, as well as biographies of the sponsors, their track record and investment focus.

- A limited partnership agreement defines the relationships, rights and duties of partners involved, including allocations, distributions, claw-backs and investment restrictions.

- A subscription agreement includes the investor commitment, closing conditions and representations.

- An investor questionnaire gathers required information about the accredited investor. It typically includes the investor’s Employee Retirement Income Security Act (ERIA) status, a list of any National Association of Securities Dealers (NASD) restricted persons and PATRIOT Act compliance, as well as contact information.

How PE startups are regulated

PE funds are regulated by the Securities Act of 1933, the Investment Company Act of 1940, the Investment Advisors Act of 1940, the Securities Exchange Act of 1934, and ERISA.

Legal counsel should review the fund structure and potential investors before the offering to ensure compliance with U.S. federal regulations.

Exemption from Securities and Exchange (SEC) registration is possible under certain circumstances (e.g., if there is no general solicitation, fewer than 100 investors, no commissions are being awarded to the GP for sale of partnership interest, or if the GP will perform substantial duties for the partnership).

Before you solicit funds for a PE

Make sure you accomplish all the structure- and legal-related tasks before you solicit significant contributions from investors or loans from creditors to start up a PE fund. Form the entity, develop organizational documents, create subscription packages and finish the SEC filing plan first.

Experienced investors and lenders expect complete and compliant documentation to consider making a significant investment in a PE fund. The pertinent pool of potential investors will not take a PE fund seriously without these fundamental elements in place.

How Wipfli can help

Wipfli can help you achieve growth and compliance. We offer a full suite of fund services to help you form PE funds, grow your business with confidence, and manage performance. We combine our experience with leading technology to help you create and preserve more value. Contact us today to learn more.

Related content: