“These projections are realistic, but there are a lot of variables,” said Anna Kooi, partner and financial services practice leader at Wipfli. “If firms are counting on market performance or M&A to support growth, that’s outside their control. The levers they can control — like strengthening distribution and driving organic growth — have been harder to activate.”

At the same time, the operating environment has become more complex. Asset managers are facing intense pressures — from evolving compliance expectations to shifting market dynamics, fee and product competition and accelerating technology demands.

“Firms are optimistic, but they’re also managing more moving parts than ever before,” Kooi said. “Success depends on how well leaders can prioritize and execute amid all that noise.”

Recent market swings have also reinforced the role of active management. “Periods of disruption give investors a reason to look beyond index strategies,” Kooi said. “They want to see where managers can generate alpha — and technology is becoming the way to deliver that.

Asset managers are already leaning on data and AI:

- 81% of respondents said they use AI and data analytics to support decision-making.

- 38% reported using real-time insights to guide automated decision-making and business strategy.

- 43% said they use predictive models and dashboards.

Yet data foundations are also a constraint. Respondents named data privacy and security as barriers to implementing data analytics effectively, followed by data quality issues, high costs and integration with existing systems.

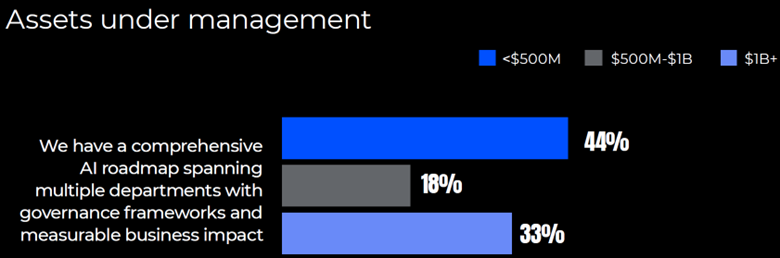

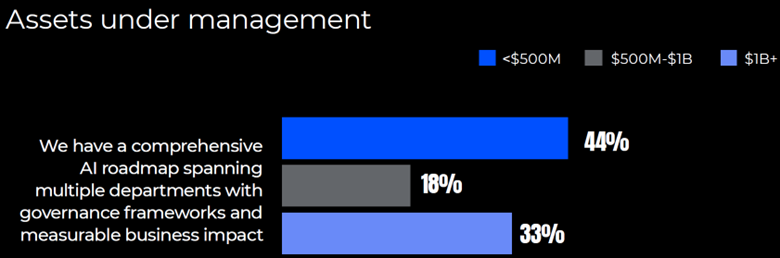

Most firms reported using AI in some capacity, but relatively few have reached enterprise-level maturity. “A lot of firms are experimenting,” Kooi said. “They may have AI embedded in certain tools or workflows, but that’s not the same as having a roadmap that ties back to investment and business strategy.”

True maturity, he said, will require discipline. Asset managers that integrate digital capabilities into their core investment and operating models — not just around the edges — will be best positioned to compete in a volatile, opportunity-rich market. Firms need structured plans that link investment performance, operational efficiency and distribution strategy with realistic, measurable goals.

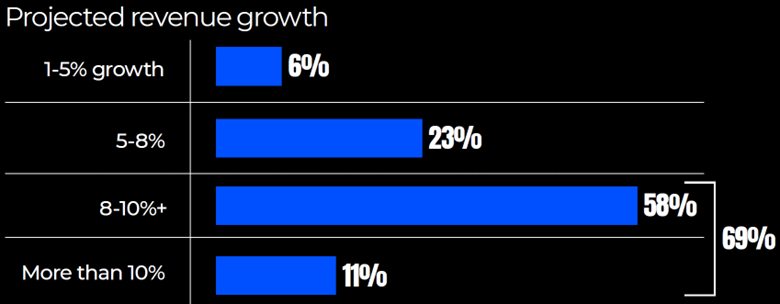

Nearly all respondents expect their firm’s revenue to grow in the next 12 months, and 69% project growth of 8% or higher.

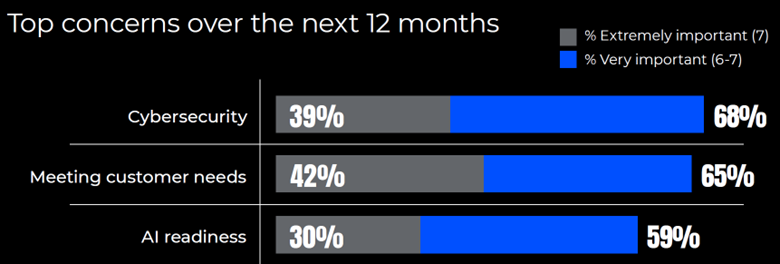

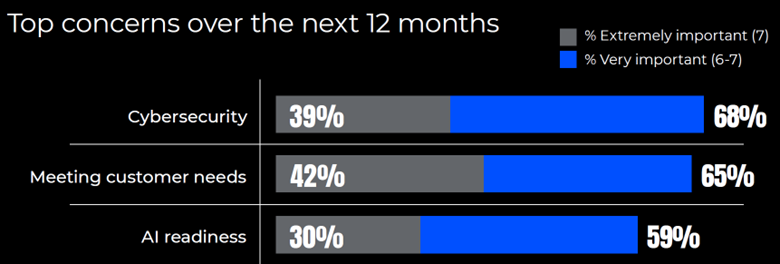

Across a broad list of concerns, technology-related factors consistently ranked near the top.

Most respondents said their firms are actively implementing AI solutions in targeted areas. Respondents from large firms were more likely to report having a comprehensive AI roadmap.

Covered in the full report

- Growth expectations: Nearly all respondents expect revenue growth in the next 12 months, and 69% expect gains of 8% or more.

- Growth drivers: Improving digital customer engagement and data analytics were the top-ranked growth strategies overall, with priorities often differing by firm size.<

- Cybersecurity: For the third year in a row, cybersecurity ranked as a top concern.

- Technology: Nearly 70% of respondents said cybersecurity and data privacy measures have a “large” or “major impact” on how they do business. More than two-thirds also cited data analytics and digital tools for account management efficiency.

- AI strategies: Most respondents report implementing AI solutions or having an AI roadmap — but far fewer have achieved the level of governance, integration and measurement associated with true maturity.

- Next steps: Wipfli advisors add context and offer strategies to help asset management leaders sustain their confidence, sharpen their edge and turn momentum into long-term maturity.

Download the full report for deeper analysis and an appendix with all the data. For media inquiries, contact Alicia O’Connell at alicia.oconnell@wipfli.com.

Download the full report