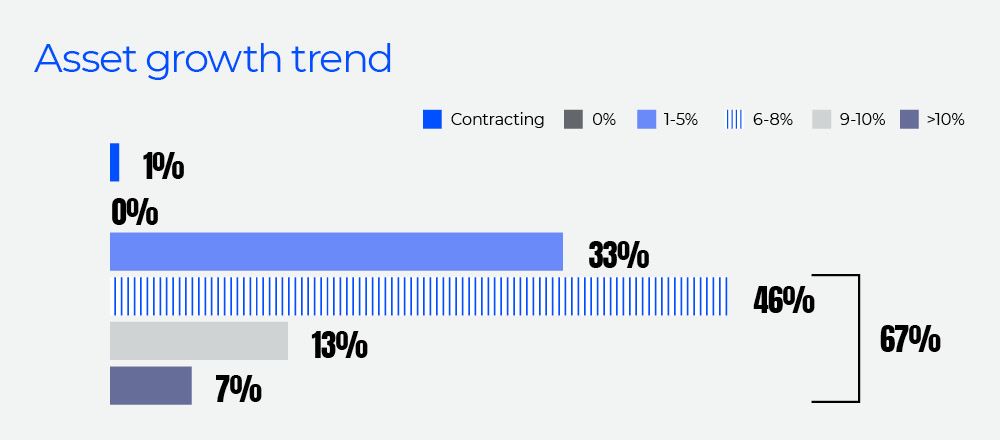

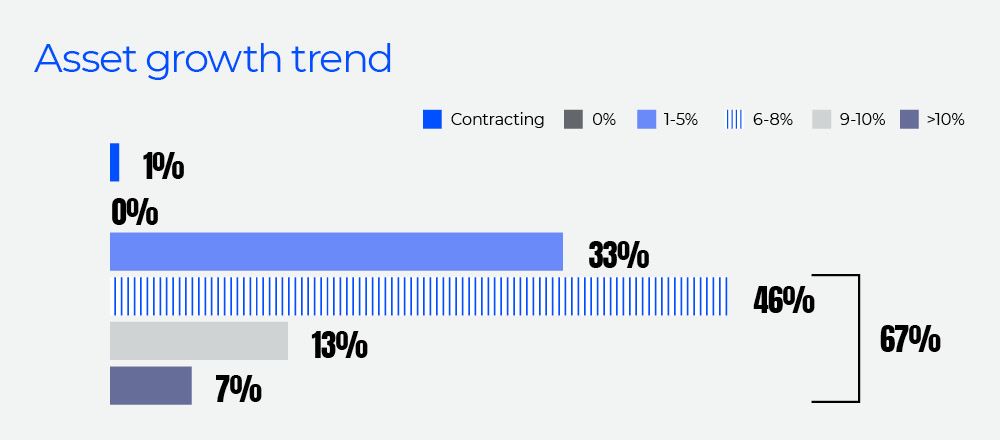

In this year’s survey, confidence remains strong, with a clear majority of respondents expecting growth in the year ahead. Respondents from large institutions reported the most bullish outlook, with 79% growth above 5%.

“Boards expect growth no matter what the economy is doing,” said Robert Zondag, partner at Wipfli. “That creates pressure on leadership teams to hit targets even when rate environments, employment cycles and market stability are outside their control.”

And while many market indicators remain strong, conditions could shift quickly. Recent layoffs at large employers, changing spending behaviors and potential market corrections could affect borrower segments faster than leaders anticipate.

Demographic and generational shifts could also be shaping growth strategies more directly than banking leaders realize.

“Younger consumers simply don’t bank the way previous generations did,” said Carlos Vega, director at Wipfli. “If institutions don’t develop digital-native experiences and stronger acquisition strategies, they’ll lose ground.”

“Maintaining safety and soundness is important,” added Alison Herrick, a partner at Wipfli. “But it can also mean institutions aren’t building capabilities that will be required for future growth. When they fall behind, the gap widens every year.”

Emerging payment models — including stablecoins, digital wallets and AI-driven transactions — could further reshape customer expectations and accelerate the digital shift.

“AI FOMO — the fear of missing out — is real,” Vega said. “Leaders want to show progress, even though they’re still wrestling with foundational data challenges, like quality, governance and integration.”

Roughly two-thirds of respondents (65%) said their institutions are either researching or actively implementing AI solutions. However, only 16% said their institutions have an enterprise-wide roadmap for AI that includes governance frameworks and measurable business impact.

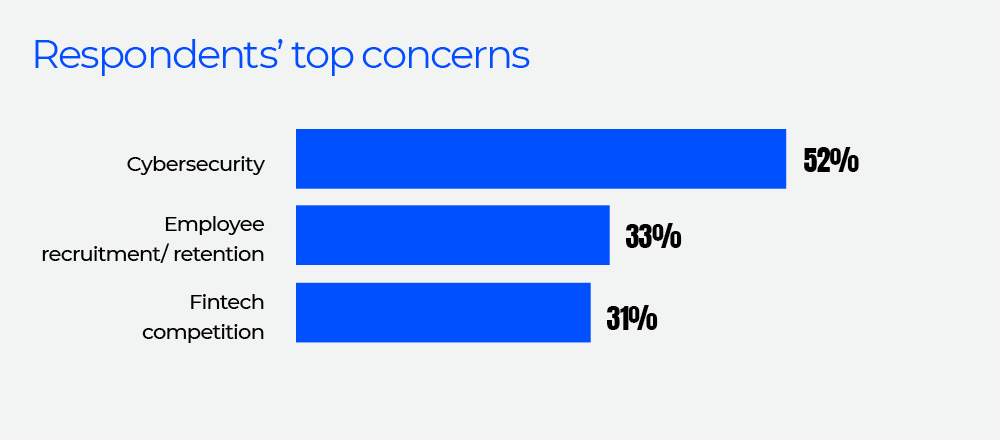

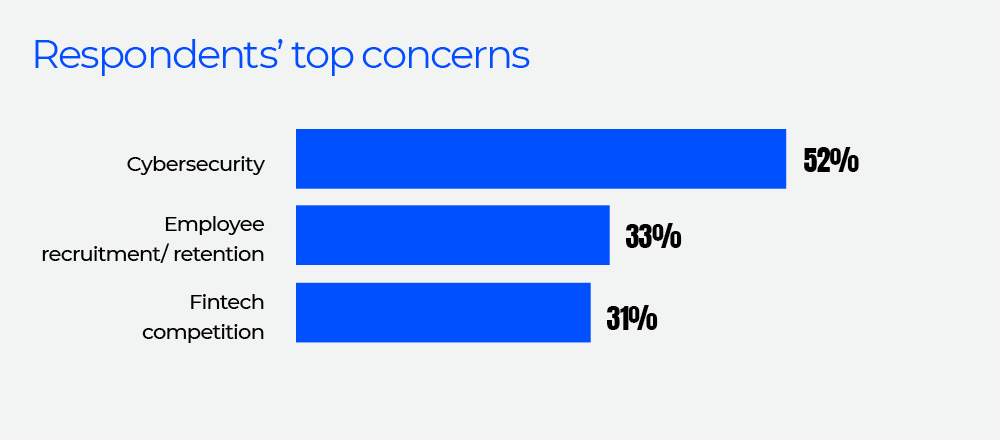

Cybersecurity and fraud are another persistent pressure point. Cybersecurity was the top concern among the leaders we surveyed — and by a wide margin. Eighty-one percent of respondents said their institution experienced at least one incident of unauthorized access in the last 12 months — up from 65% last year. Respondents also reported increasing activity across several threat categories.

“As institutions expand access and speed, fraud exposure grows right alongside it,” said Zondag. “Digital conveniences introduce new vulnerabilities if underlying controls don’t evolve at the same pace.”

AI is also reshaping the threat landscape. Attackers are adopting AI-powered tools — including deepfake audio, synthetic identities and automated phishing — faster than many institutions are updating their defenses.

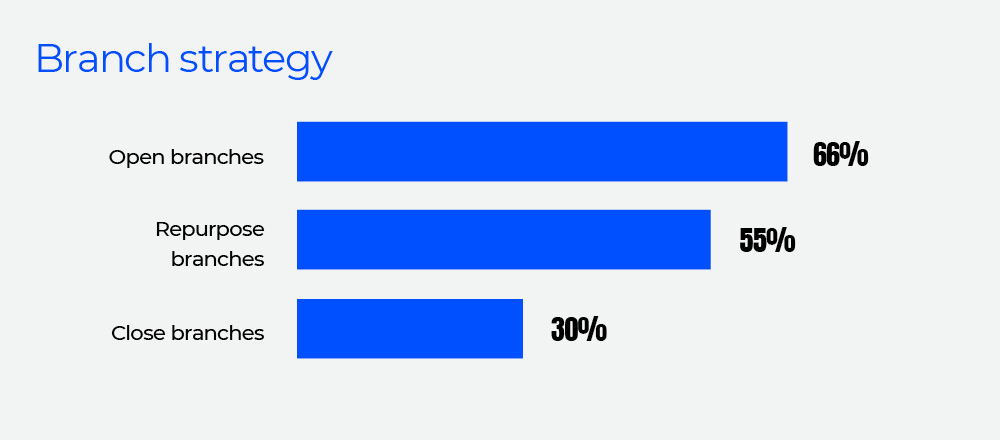

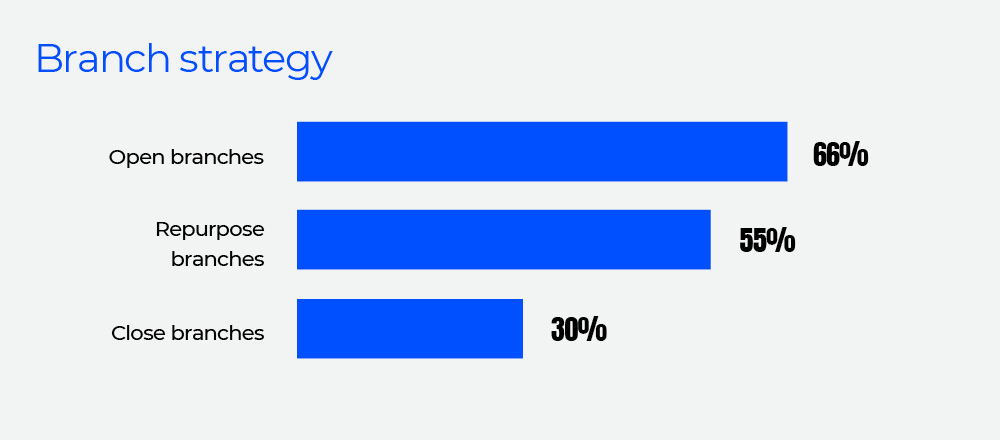

As digital channels absorb the transactional load, branch strategies are increasingly tied to growth and market-entry objectives rather than transactional demand. Rather than retreating from brick-and-mortar, many respondents indicated plans to open branches or repurpose existing locations. Among the executives we surveyed:

- 66% said their organization plans to open branches in the next 12 months

- 55% plan to repurpose existing branches to support new banking experiences

- 30% plan to close branches

Respondents also cited the strategic impact of talent gaps. Sixty percent of respondents said talent gaps or shortages could affect their institution’s ability to achieve strategic priorities.

High-demand skill sets in IT, cyber, data and risk remain difficult — and expensive — to fill. At the same time, many institutions are facing looming gaps in roles that rely heavily on institutional knowledge and experience — qualities that are difficult to replace through automation alone.

“People who’ve seen multiple market cycles have critical perspective and expertise,” said Anna Kooi, partner and financial services practice leader at Wipfli. “Replacing that judgment isn’t easy, especially when newer professionals haven’t experienced a downturn firsthand.”

More than ever, strategy execution depends on how well institutions align talent, technology and culture. “Technology can amplify people — but it can’t replace them,” Kooi said.

Most respondents expect growth in the next 12 months, with roughly two-thirds projecting growth of 5% or higher.

When asked to identify their most important strategies for the next 12 months, respondents placed the greatest emphasis on digital initiatives.

For the third consecutive year, cybersecurity was respondents’ top concern.

Two-thirds of respondents said their institutions plan to open a new branch within the next 12 months.

The full report also covers:

- Growth trends: See how growth projections have changed over the years — and how they vary by asset size.

- Strategic levers: Respondents shared their top growth strategies, digital strategies and recently added services.

- Cyber responses: Learn how respondents say they’re fortifying defenses against rising fraud and cybersecurity threats.

- AI strategies: Respondents using AI revealed their top use cases.

- Branch strategies: See what factors weighed into branch strategy decisions, plus how executives said they plan to repurpose existing locations and serve accountholders after closures.

- Talent: Respondents who cited employee recruitment and retention as a top concern shared actions they’ve taken to address workforce pressures.

- Next steps: Wipfli advisors add context and offer strategies to help leaders grow, modernize and protect their organizations amid new digital realities.

Download the full report for deeper analysis and all the data. For media inquiries, contact Alicia O’Connell at alicia.oconnell@wipfli.com.

Download the report