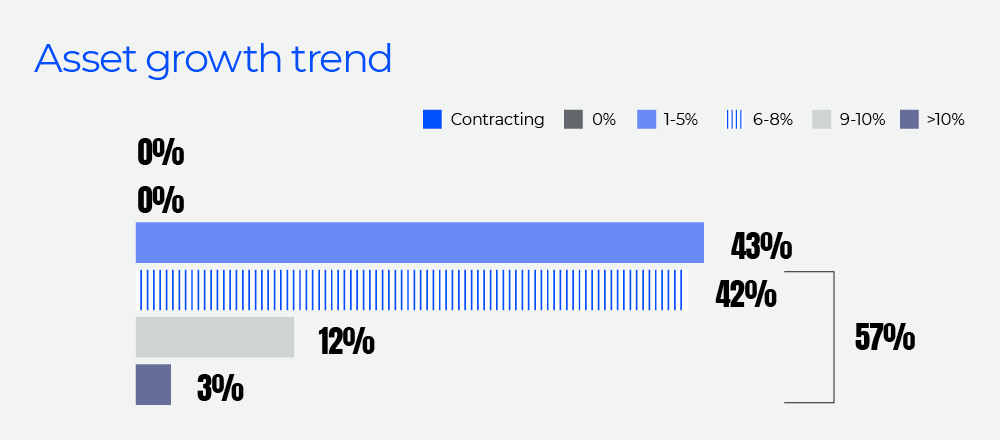

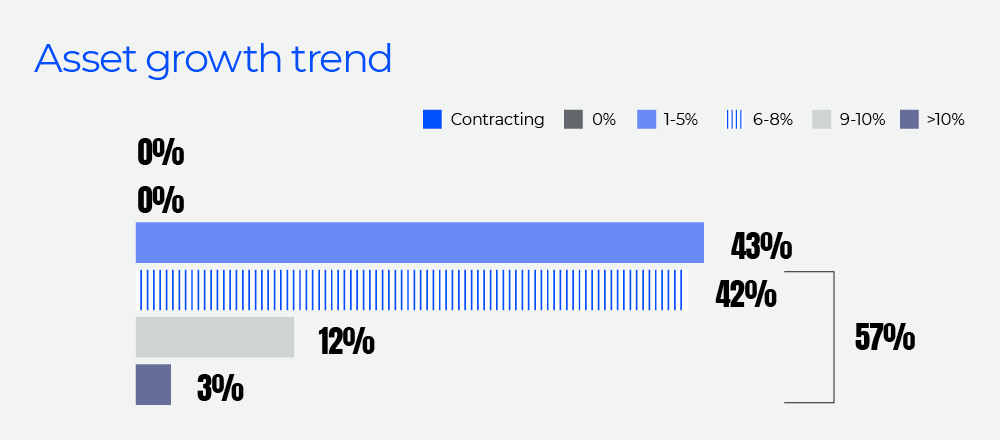

The credit union executives surveyed project steady growth in 2026. More than half (57%) of respondents expect asset growth of 5% or more in the next 12 months. Confidence was slightly stronger among respondents from large ($3B+ in asset size) and mid-sized ($1B-3B) credit unions.

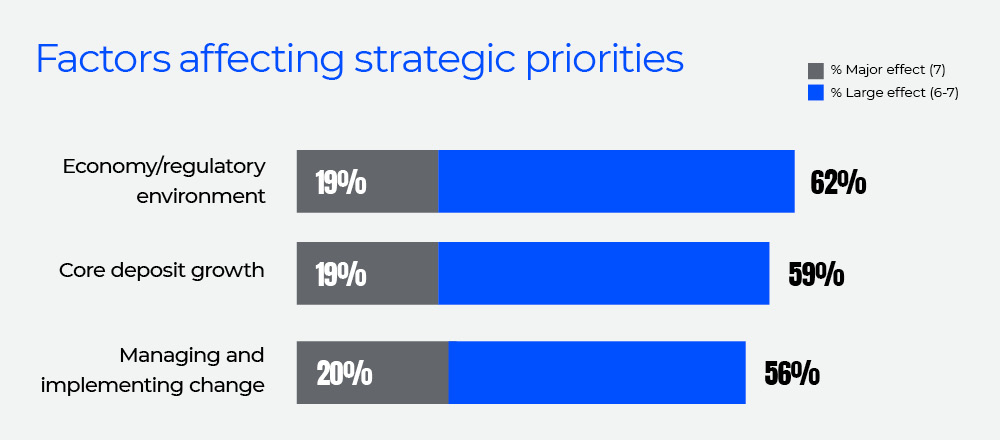

“Credit unions feel pressure to grow, but they are also stewards of member trust and their communities,” said Alison Herrick, partner at Wipfli. “That balance is harder to maintain when economic conditions, regulatory requirements and member expectations all shift at once.”

As competition over deposits intensifies, many credit unions are reevaluating their traditional growth approaches. Purchased loan pools, indirect lending models and third-party origination channels may be promising levers, particularly when organic growth is challenging to sustain.

At the same time, long-term momentum is increasingly dependent on digital engagement. “Younger consumers simply don’t bank or build relationships the way previous generations did,” said Carlos Vega, director at Wipfli. “They’re influenced by digital experiences and social platforms. If credit unions don’t adapt their engagement strategies to match, they could risk losing relevance.”

In this year’s survey, “improving digital member engagement” ranked as the most important strategy for the next 12 months, closely followed by data analytics/AI. Accepting instant payments, automating processes and BaaS/embedded banking rounded out the top five priorities.

Ninety-two percent of respondents said their credit union is either participating in or planning to participate in BaaS/embedded banking within the next 12 months — up from 67% last year. Executives from mid-sized and large credit unions were more likely to report current or planned participation.

Survey results also show widespread AI adoption, with nearly eight in 10 respondents (79%) either researching or actively implementing AI solutions. Wipfli leaders attribute this high adoption rate to vendor-enabled tools embedded in existing platforms.

“Many credit unions are using AI because it’s available, not because it’s part of a deliberate strategy,” Vega said. “Much of today’s AI use is operational — fraud detection, financial reporting, risk analysis — rather than member-facing or growth-oriented.”

Overreliance on vendor solutions can also limit innovation. “If everyone is using the same tools in the same way, the competitive advantage disappears,” Vega said. “Real value comes from how AI is applied, not whether or not a feature is turned on.”

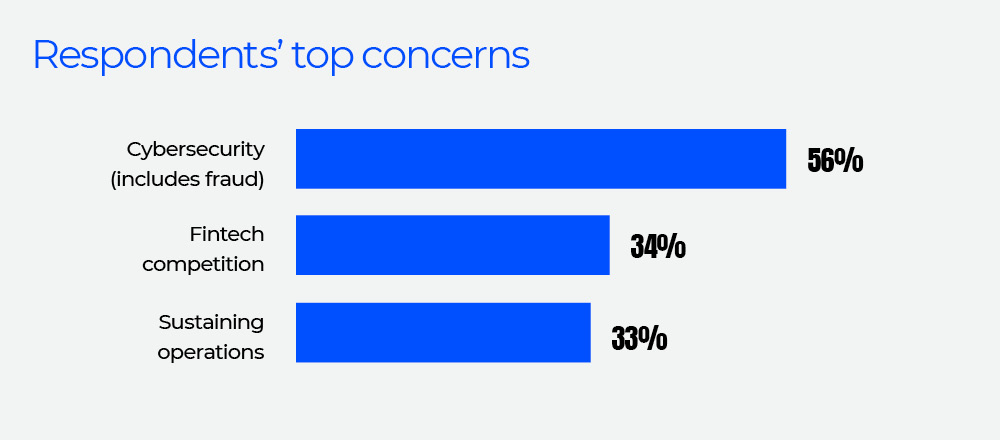

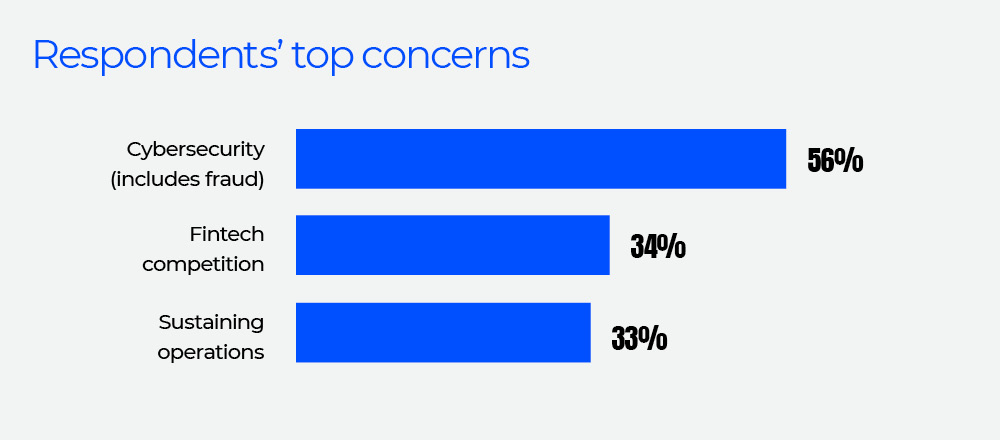

As credit unions expand digital access and add member-facing capabilities, fraud and cyber risks rise in parallel. Cybersecurity was the top concern among the credit union executives we surveyed — and the top concern across every asset tier. Seventy-seven percent of respondents said their institution experienced at least one incident of unauthorized access to networks or data in the last 12 months.

Bad actors are increasingly using AI-powered tactics, including deepfake audio, identity spoofing and automated phishing, to scale attacks and make them harder to detect. “We’re seeing fraud attempts that look shockingly real,” said Anna Kooi, partner and financial services practice leader at Wipfli. “The risk isn’t hypothetical anymore. It’s happening in the field.”

As technology and partnerships evolve, leaders must balance innovation with mission to help ensure growth strategies protect members and strengthen trust. “Protecting what you’ve built is important,” Herrick said. “But if you don’t invest in new capabilities, the gap between member expectations and what you can deliver widens.

“Growth strategies have to respect the mission while adapting to digital, demographic and regulatory realities,” Herrick said.

Most respondents expect growth in the next 12 months.

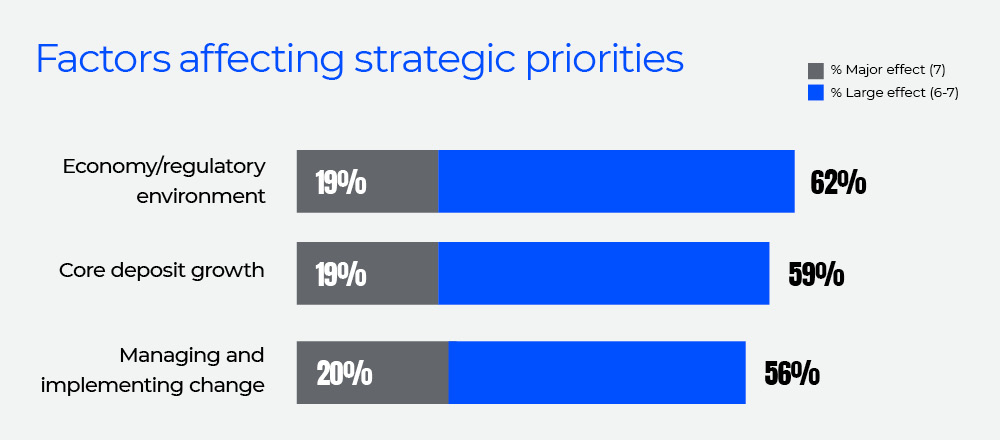

When credit union leaders ranked their top strategic priorities for 2026, digital initiatives topped the list.

Cybersecurity was respondents’ top concern.

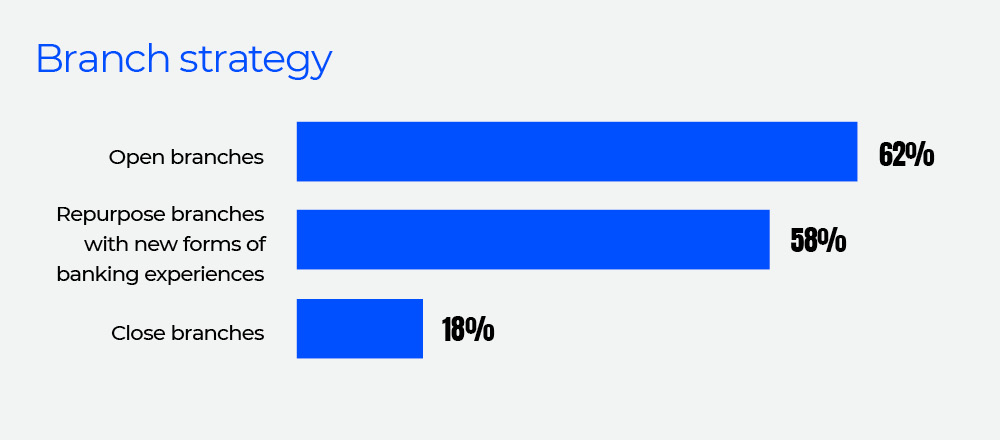

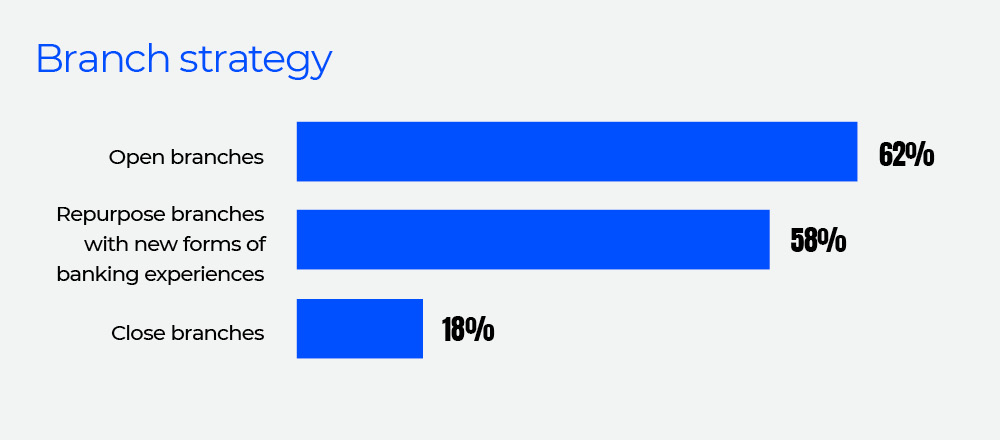

Most respondents plan to open or repurpose branches within the next 12 months.

The full report also covers:

- Growth trends: See how growth projections have changed over the years — and how they vary by asset size.

- Strategic levers: Respondents shared their top growth strategies, digital strategies and recently added services.

- Cyber responses: Learn how respondents say they’re fortifying defenses against rising fraud and cybersecurity threats.

- AI strategies: Respondents using AI revealed their top use cases.

- Branch strategies: See what factors influenced branch strategy decisions and how executives said they plan to repurpose existing locations.

- Next steps: Wipfli advisors add context and offer strategies to help leaders adapt to modern member needs.

Download the full report for deeper analysis and all the data. For media inquiries, contact Alicia O’Connell at alicia.oconnell@wipfli.com.

Download the report